An analysis of relative capital structures

Investment decision making is the most important ongoing activity for any company, and a company can only increase its share price and the return it provides to shareholders by undertaking positive-NPV investments. What is also of relevance in supporting the investment decision is determining the most appropriate means of financing these profitable investments—the capital structure or financing decision.

This capital structure decision-making process involves an evaluation of numerous factors. These range from simple issues such as the relative advantages of using debt, equity and alternative forms of finance to complicated considerations relating to taxation, profitability and corporate-risk implications and the effect of such decisions on related parties such as major external shareholders and debt covenants established with prior financiers. Beyond these issues, it is of paramount importance to contemplate the nature of the company itself, the ongoing demands and business cycle of the firm’s operations and what, if any, industry-specific determinants may influence or dominate its financing choice.

Critical to any decision relating to capital structure change is an evaluation of the risk profile of the company. Issuing additional debt or equity finance will have obvious explicit cost consequences, either in the form of greater interest payments and debt-servicing costs or an obligation to provide dividends or other distributions of capital over a wider quity base. Similarly, there can be implicit costs associated with such financing decisions, although these tend to be less emphasised or factored into capital structure decision making. These implicit costs relate particularly to the risk profile of a company, with certain companies thought to be more or less risky than others owing to the nature of their activities or the predominant industry in which they operate. It is, therefore, important to consider the general level of risk associated with companies and let such considerations inform financing decisions.

As such, it is important to consider the levels of both business risk and financial risk faced by a company when making capital structure decisions. Various items of information can be considered when analysing these different risk exposures. Business risk relates to the earnings stability of the company’s operations and its susceptibility to industry- or economy-specific shocks. Financial risk is derived from the degree of financial leverage or debt financing employed by the company, which is a company-specific management decision. As such, general risk aversion principles suggest that companies with more certain earnings and less business risk would be more likely to employ greater debt finance whereas firms with higher business risk would be less inclined to increase their overall risk profile by taking on high levels of financial leverage. Similarly, it would be expected that a company with higher financial leverage should provide a higher relative return to equity holders as implicit compensation for their facing greater financial risk. These relationships would be predicted by the Modigliani and Miller, trade-off and traditional theories of capital structure, but are not necessarily consistent with applying a pecking order to financing decision making.

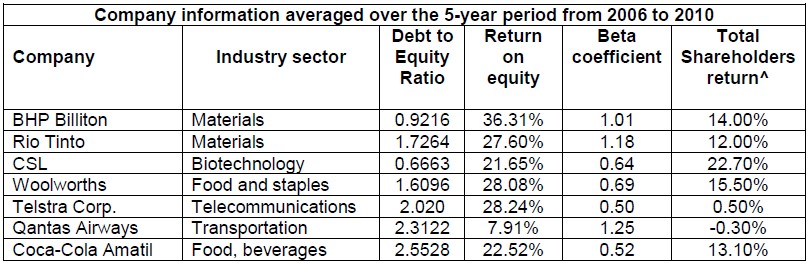

One means of evaluating the accuracy of these theories to real-life capital structure decision making is to examine the capital structure and operating characteristics of listed companies. The following table provides information for a number of well-known Australian listed companies as a means of addressing this issue.

^ Share return is calculated as the percentage change in the share price from the end of financial year 2006 to end of financial year 2010.

Answer the following questions:

1. Consider, initially, the companies listed in the above table and their industry classifications. Suggest which companies you would consider to be the most risky based on the nature of their industry and give reasons for your suggestions.

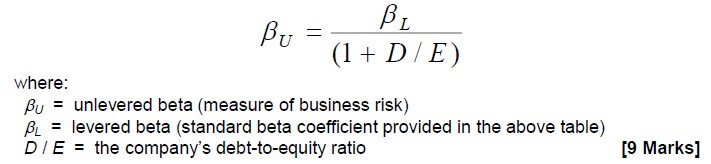

2. Using the information provided, calculate the level of business risk for each firm. Is the relationship between business and financial risk levels consistent with what traditional capital structure theory would suggest? If not, outline what theory of capital structure the above companies appear to be following. Business risk can be calculated as the unlevered (asset) beta, using the following equation:

3. Compare the financial information in the above table for the two companies in the materials industry, BHP Billiton and Rio Tinto. Explain any differences that exist between the figures for the two companies and outline what this suggests in terms of capital structure decision making within specific industry sectors.

SAMPLE ANSWER:

Here BHP Billiton and Rio Tinto both are in same industry sector but there financial structure is very different as Rio Tinto is having D/E ratio approximately double to BHP Billiton D/E ratio. It suggest apart

from industry there are several other factors that decide financial structure of a company. Some of these factors are

1) Management: – Management decide the strategy for the company. Aggressive management may like higher leverage than a defensive management.

2) Size of the company: – Size of one company is very large and thus it has enough resources available to it while other company may be in its initial stage and may not have that many resources available to it.

To get an access on the complete solution towards this assignment email: [email protected] or chat with us live.