Financial Analysis and Modeling

PART 5

| In column E, 1 indicates that the project will be selected and zero otherwise. If you want to find the cost weighted average IRR of just those projects that will be selected, what should be the right formula on cell B7 using an array formula? | |

| a. =SUM(B2:B5 *$E2:$E5)/B6 | |

| b. {=SUM(B2:B5*D2:D5*$E2:$E5)/B6} | |

| c. ={SUM(B2:B5*D2:D5*$E2:$E5)}/B6 | |

| d. =SUM(B2:B5*D2:D5*$E2:$E5)/B6 | |

| e. {=SUM(B2:B5*$E2:$E5)/B6} |

| A proposed investment project will generate sales of 3K units at a price of $20 per unit. The fixed costs are $8,000 and the variable costs per unit are $15. The project requires $20,000 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the project’s 4-year life. If the tax rate is 34%, what should be the formula on cell B8 to calculate the operating after-tax cash flows for year 5? | |

| a. =(B1/(B2+B4)+B3)/(1-B7)-(B5*B6/B7) | |

| b. =B1*B2-B4-B3*(1+B7)+B5/B6*B7 | |

| c. =(B1*B2-B3)*(1+B7)+B5/B6*B7 | |

| d. =(B1*(B2-B4)-B3)*(1-B7)+B5/B6*B7 | |

| e. =(B1*(B2-B4)-B3)*B7+B5/B6*B7 |

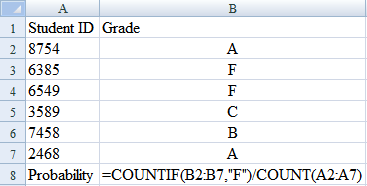

| What would be the outcome of cell B8? | |

| a. 20.00% | |

| b. 30.00% | |

| c. 33.33% | |

| d. 50.00% | |

| e. 66.67% |

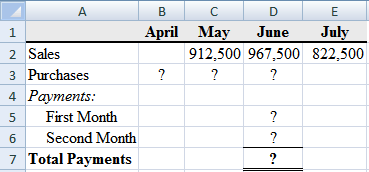

| In cell B8, what are the cash dividends paid to shareholders? |

| If raw materials inventory purchases are equal to 60% of the following month sales, half of purchases are paid for in the month following the purchase, and the remainder is paid in the following month, what are the total payments (cell D7) |

To access towards the answers towards the above questions email : [email protected] or chat with us live.