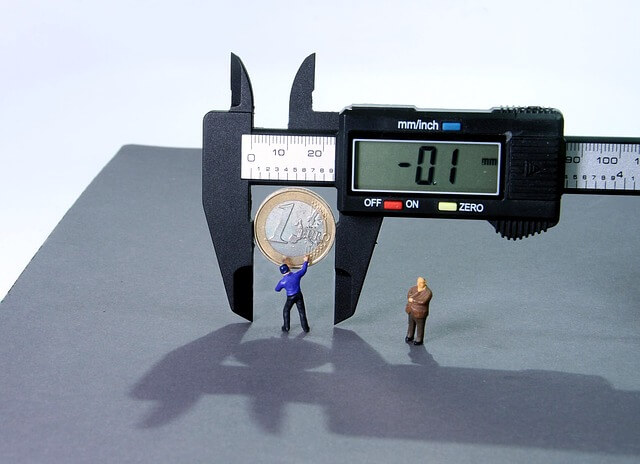

Interest Rate risk

Interest rate risk of longer-term bonds

Assignment(use Excel formula to solve these questions)

1. Suppose the real rate is 2.5 percent and the inflation rate is 4.7 percent. What rate would you expect to see on a Treasury bill?

2. Laurel, Inc., and Hardy Corp. both have 8percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Laurel, Inc., bond has 2 years to maturity, whereas the Hardy Corp. bond has 15 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of these bonds be then? Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds?

SAMPLE ANSWER :

The Bond prices are directly related to the yield they discount at the given rate. A 2% higher discounted yield will reduce the price of the bond by the same

3. Paul Adams owns a health club in downtown Los Angeles. He charges his customers an annual fee of $500 and has an existing customer base of 500. Paul plans to raise the annual fee by 6 percent every year and expects the club membership to grow at a constant rate of 3 percent for the next five years. The overall expenses of running the health club are $75,000 a year and are expected to grow at the inflation rate of 2 percent annually. After five years, Paul plans to buy a luxury boat for $500,000, close the health club, and travel the world in his boat for the rest of his life. What is the annual amount that Paul can spend while on his world tour if he will have no money left in the bank when he dies? Assume Paul has a remaining life of 25 years and earns 9 percent on his savings.

Check out our finance assignment help for more details .

To access the complete assignment email: [email protected] or chat with us live