Capital Budgeting and Leasing

Qantas is considering the purchase of either a new Boeing B747-400ER or an Airbus A340-600E for use on the Perth-London-Perth route.

The cost of a 747-400ER is $US256m and the cost of an A340-600 is €198m. Exchange rates are $US1.00 = AUD1.15 and €1.00 = AUD1.45.

Both aircraft have an effective life of 25 years. Qantas uses the straight line method of depreciation and usually disposes of its aircraft at the end of 10 years. The sale price for Qantas aircraft after 10 years averages 62% of the cost price and it usually takes Qantas a year to sell an aircraft and receive the proceeds. Qantas pays tax in Australia at the standard company rate of 30%. Tax is paid in the same year as the relevant transactions.

Qantas expects inflation to average 2½% a year over the next 10 years. Its before-tax required rate of return for purchases of this type is 17.1429%.

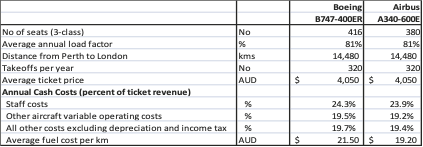

Below are some relevant details of the two aircraft:

As a new board member of Qantas you intend preparing comprehensive schedules to calculate both the NPV and the IRR of each aircraft option to determine the most cost-effective aircraft in preparation for the board meeting next week. The CEO and CFO will be making a presentation in relation to their preferred option and the means of financing the purchase. You also plan on writing a brief paragraph interpreting your results to clarify your understanding of what the NPV and IRR actually mean.

In regards to financing the preferred new aircraft, one of your fellow board members mentioned to you that “leasing is the way to go because each payment is fully tax deductible and the debt won’t appear on the balance sheet”. You are not too sure if he is correct and intend writing a brief, reasoned, statement to him supported by your calculations that either confirms or rejects his assertion that (a) leasing is the preferred option to borrowing and buying, and (b) the debt will not appear on the balance sheet.

At the last board meeting (your first as a member of the board), the CFO explained that a typical ten-year lease would consist of 9 annual payments of $40 million and a final balloon payment of $130 million. All lease payments would be made at the beginning of the relevant year. If Qantas borrowed the money from its bank to buy the aircraft instead of leasing it, it could borrow the full cost of the aircraft, fix the interest rate for 10 years at 8% a year and make 10 equal payments at the end of each year. The interest rate of 8% pleasantly surprised you because you had read in a board paper that Qantas’s imminent $1 billion bond issue will be issued at 9%.

For solution towards the above problem email: [email protected] or chat with us on live .