Budgeted Income

Topic 1

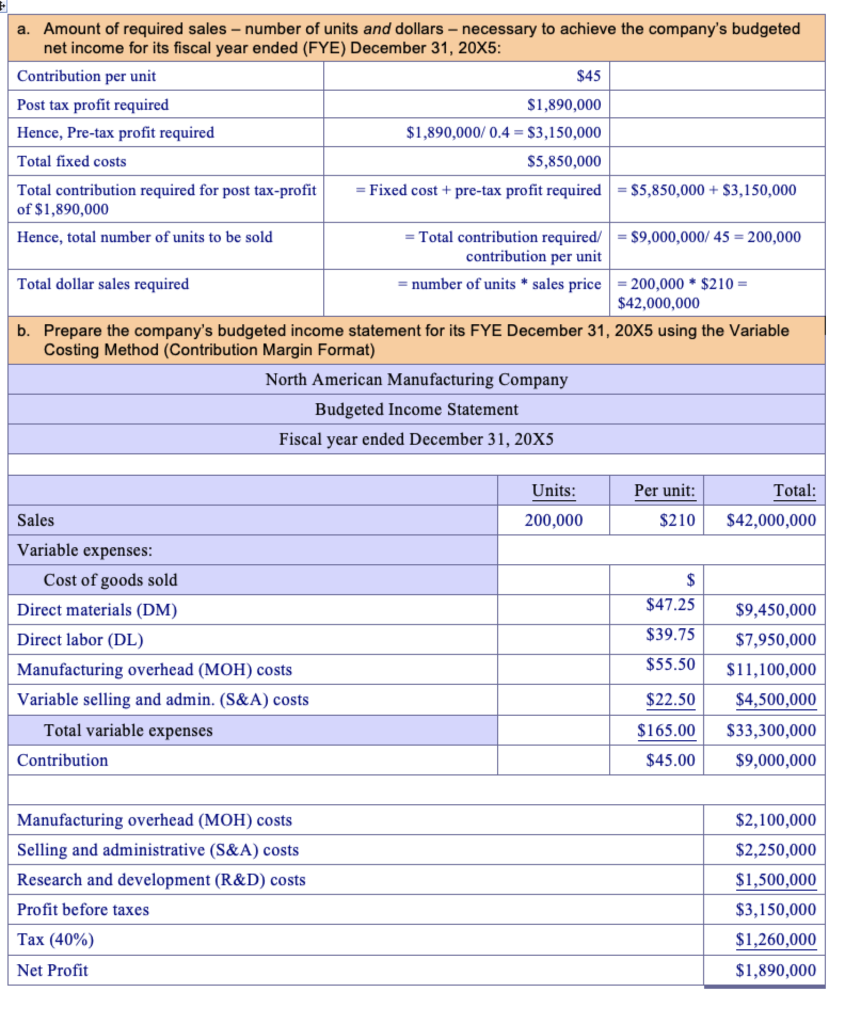

The board of directors of North American Manufacturing Company recently approved the company’s budget and production plan for its coming fiscal year, 20X5. Budgeted units of production equal budgeted unit sales for the company’s single product. Using the information below, included in the budget and production plan:

- Compute the amount of required sales – number of units and dollars – necessary to achieve the company’s budgeted net income for its fiscal year ended (FYE) December 31, 20X5

- Prepare the company’s budgeted income statement for its FYE December 31, 20X5 using the Variable Costing Method (Contribution Margin Format).

Show all computations in good form and label properly all amounts presented.

| Budgeted amounts: | Budgeted amounts: | Per unit | |

| Sales units | 200,000 | Product selling price (SP) | $210.00 |

| Sales dollars | 42,000,000 | Variable manufacturing costs: | |

| Fixed costs: | Direct materials (DM) | $47.25 | |

| Manufacturing overhead (MOH) costs | $2,100,000 | Direct labor (DL) | $39.75 |

| Selling and administrative (S&A) costs | $2,250,000 | Manufacturing overhead (MOH) costs | $55.50 |

| Research and development (R&D) costs | $1,500,000 | Variable selling and admin. (S&A) costs | $22.50 |

| Net income | $1,890,000 | Estimated combined effective tax rate | 40.0% (i.e., 0.40) |

For solution towards the above problem email: [email protected] or chat with us on live .